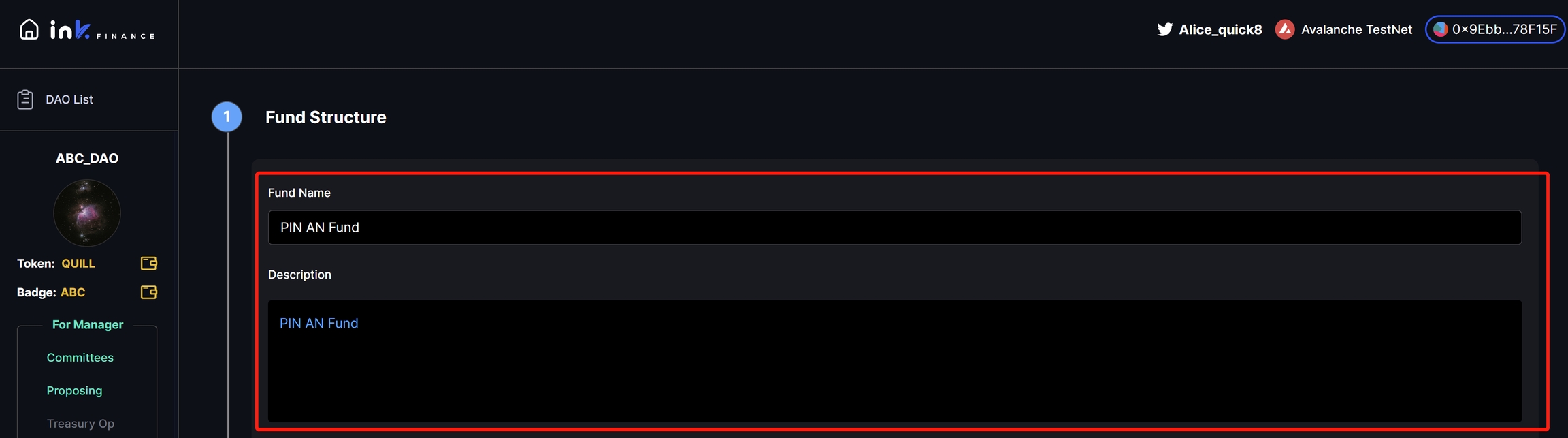

Set up Fund

Shortcut: Left panel For Manager -> Investment Op; Right panel Administration -> Set up Fund

NEW SCREEN SHOT

Step1: Give this fund a name and description

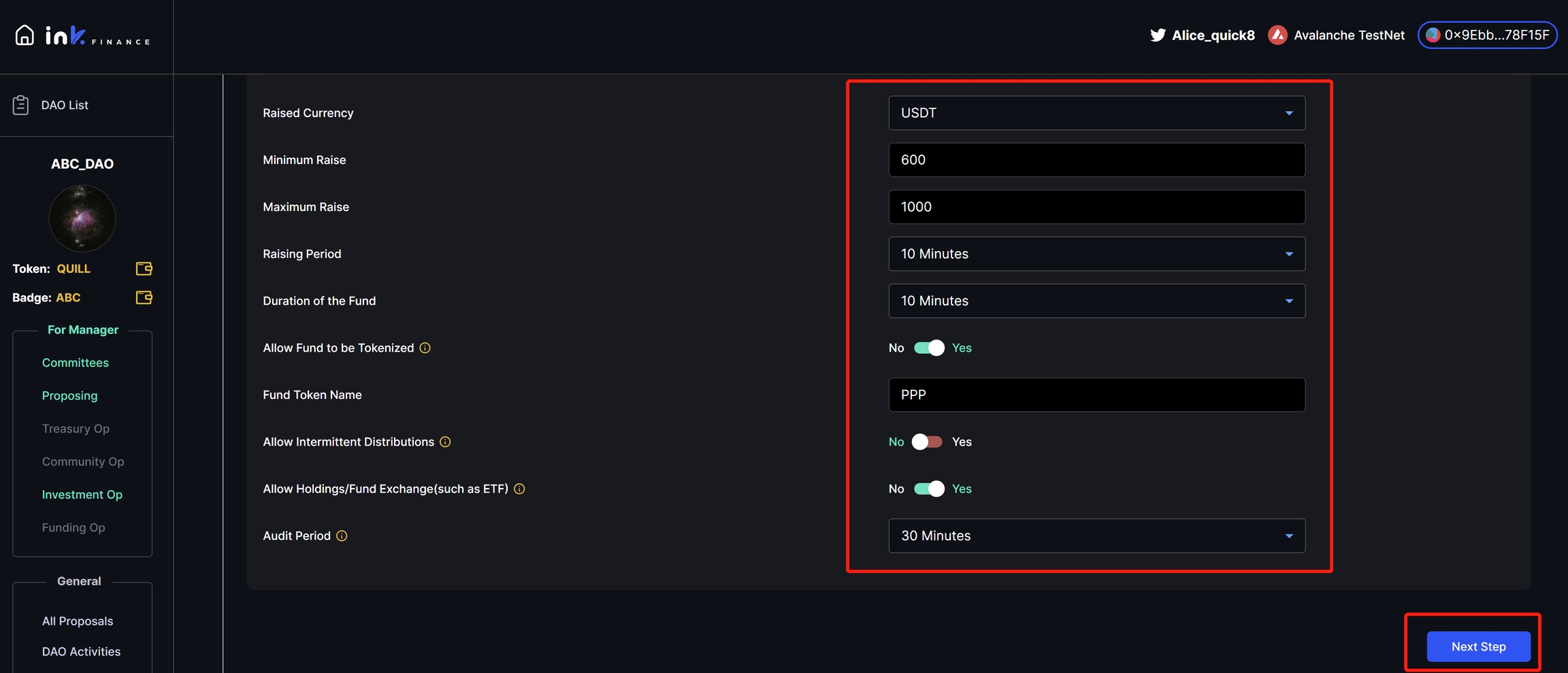

Step1: Set up Fund Structure, click Next

Fund structure includes: Raised Currency: the currency that investors put in and receive back Minimum Raise: the least amount that the fund must receive to start operation Maximum Raise: the least amount that the fund can receive before starting operation Raising Period: the window in which the Minimum Raise must be satisfied Duration of the Fund: for how long the fund can make investment after starting operation Allow Fund to be Tokenized: whether the shares of the fund can be issued as tokens Fund Token Name: Allow Intermittent Distributions: whether the fund can pay dividend during its operation Allow Holdings/Fund Exchange(such as ETF): whether the fund share can exchanged for the actual holdings in the fund Audit Period: how often the fund must have an audit

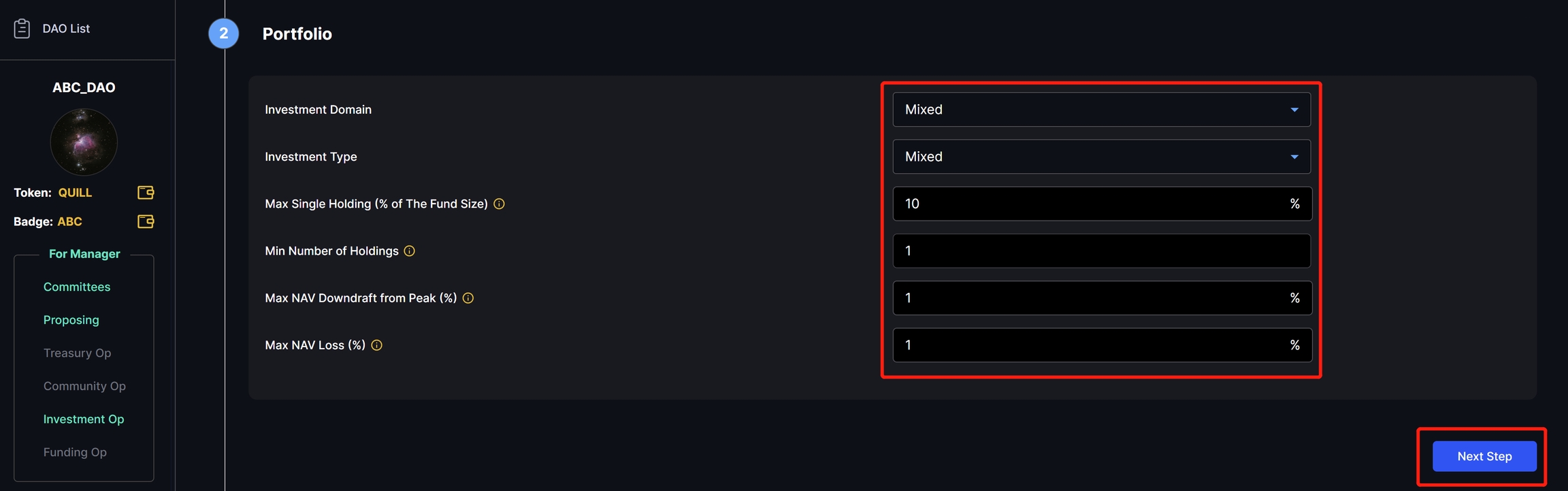

Step2: Set up fund portfolio, click Next

Fund portfolio include: Investment Domain Investment Type Max Single Holding (% of The Fund Size): how big (%) one asset can occupy in the fund Min Number of Holdings: the minimum number of assets the fund must hold Max NAV Downdraft from Peak (%): how big a drop (%) of value of the fund is allowed, measured from its peak Max NAV Loss (%): how big a drop (%) of value of the fund is allowed, measured by the raised amount

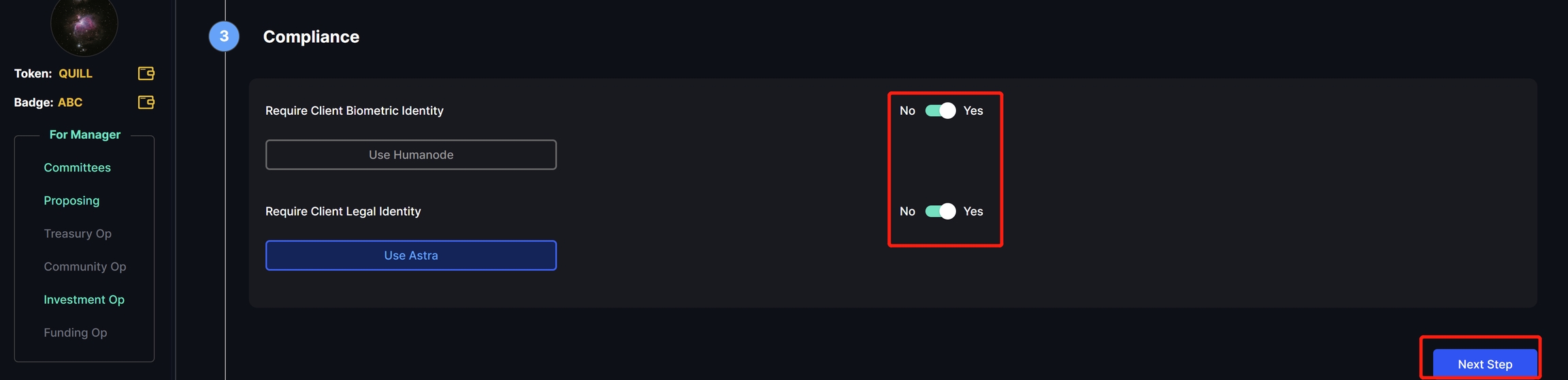

Step3: Compliance,click [next]

Compliance include: Require Client Biometric Identity, Require Client Legal Identity,

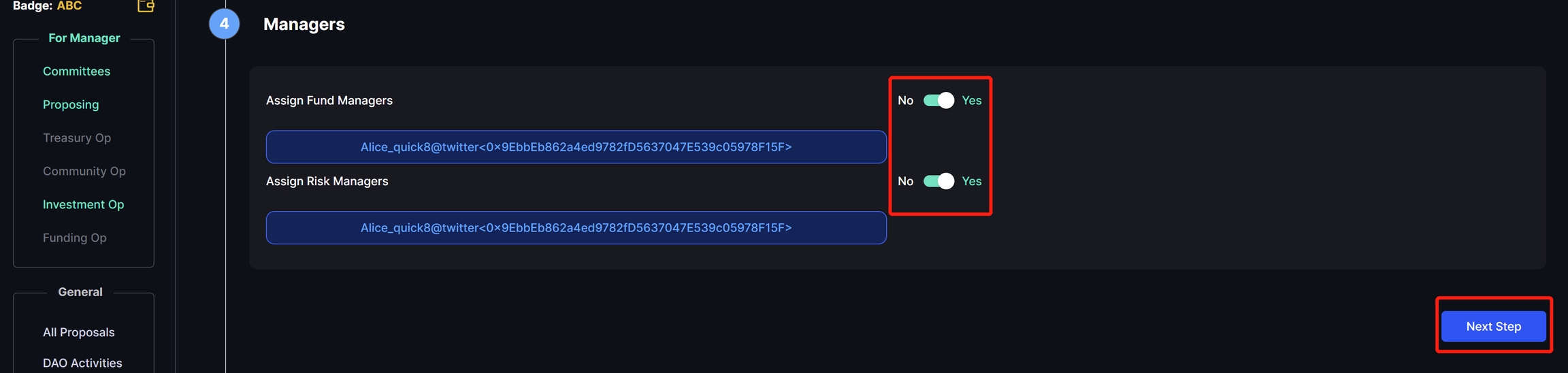

Step4: Managers,click [next]

Managers include: Assign Fund Managers, Assign Risk Managers,

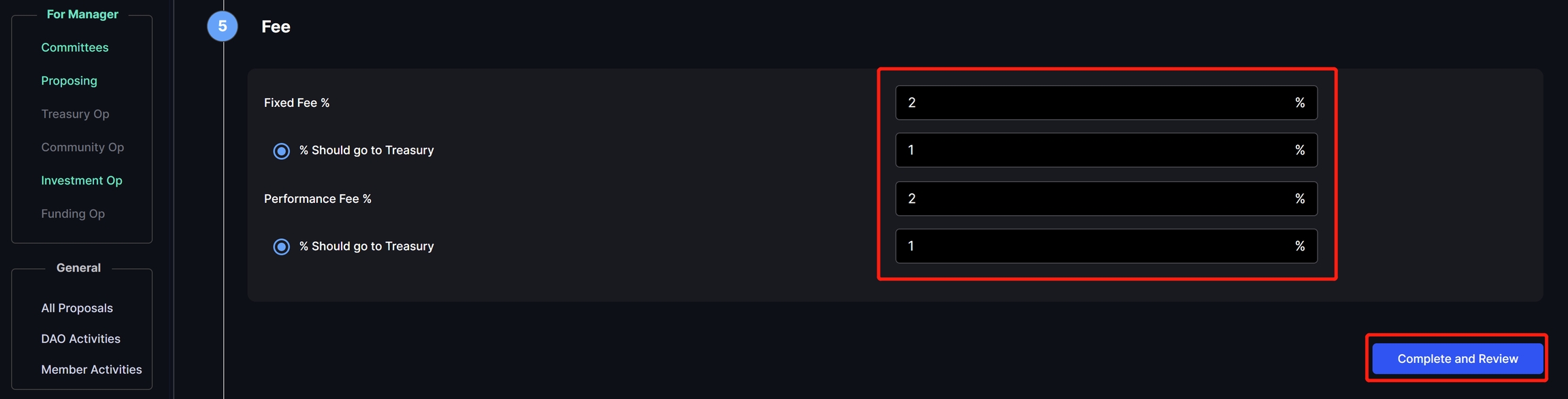

Step5: Fee, click [Complete]

Fee include: Fixed Fee %, Performance Fee %,

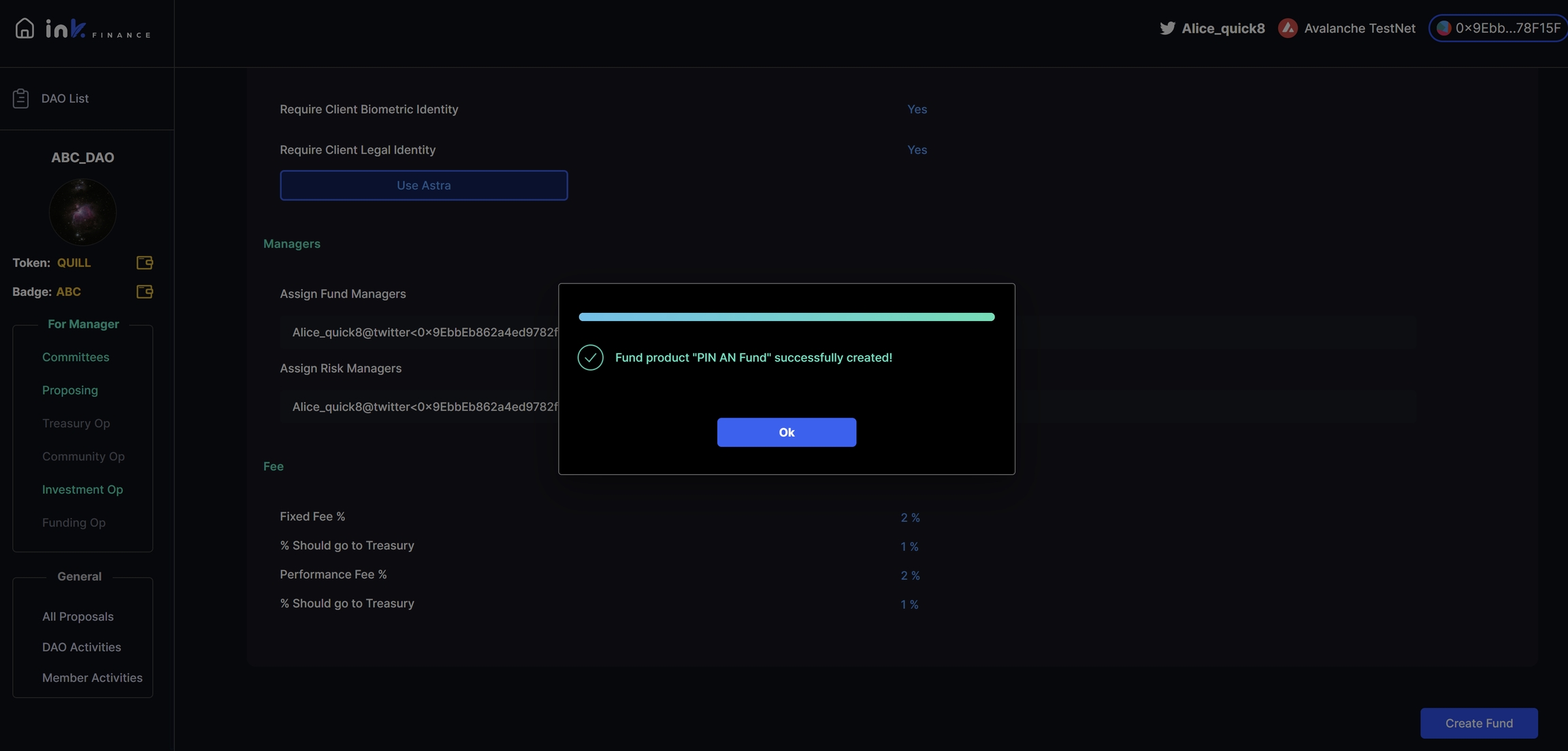

Step6: Review,click [Create Fund]

Last updated