INK Products Module

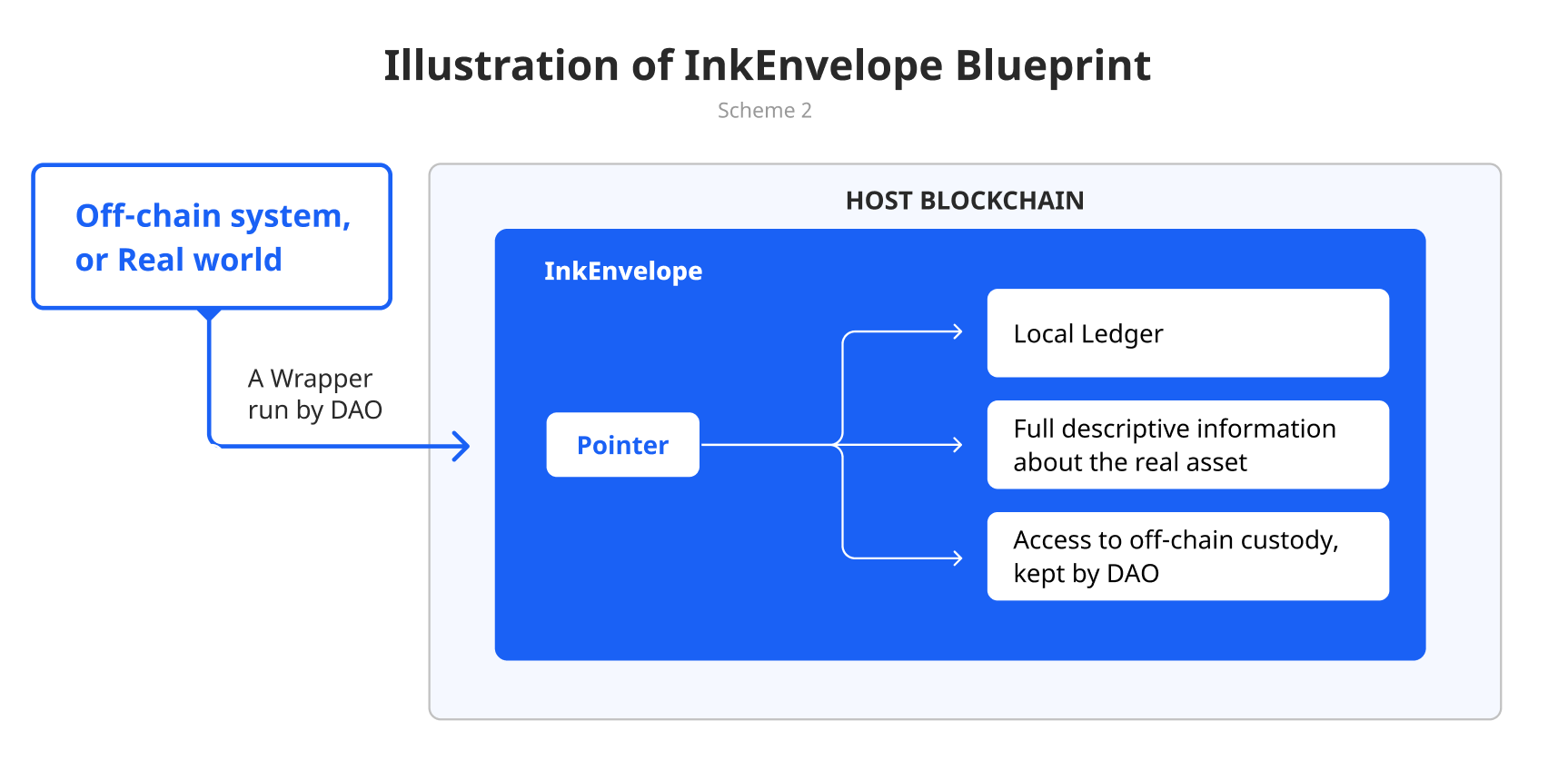

The key to INK’s customizability and flexibility is its ability to wrap any bundle of assets or financial products, and any information regarding them, into one token. This token can then be used as collateral or as a component of a fund portfolio, gaining the benefit of uniformity and liquidity on any host blockchain. In the case of physical assets which contain information such as insurance, appraisers, deeds, and so on, the INK Products Module can wrap such information into one non-fungible token (NFT), which has a totally fungible representation so that it can be handled by mainstream wallets and trading facilities. The key construct that makes this abstraction possible is the InkEnvelope, which removes the complexity of bundling any variety of assets, while preserving their descriptive information and adding a novel layer of programmability that seamlessly plugs into the world of DeFi applications. Below is the blueprint of InkEnvelope’s information composition:

Illustration of InkEnvelope Blueprint

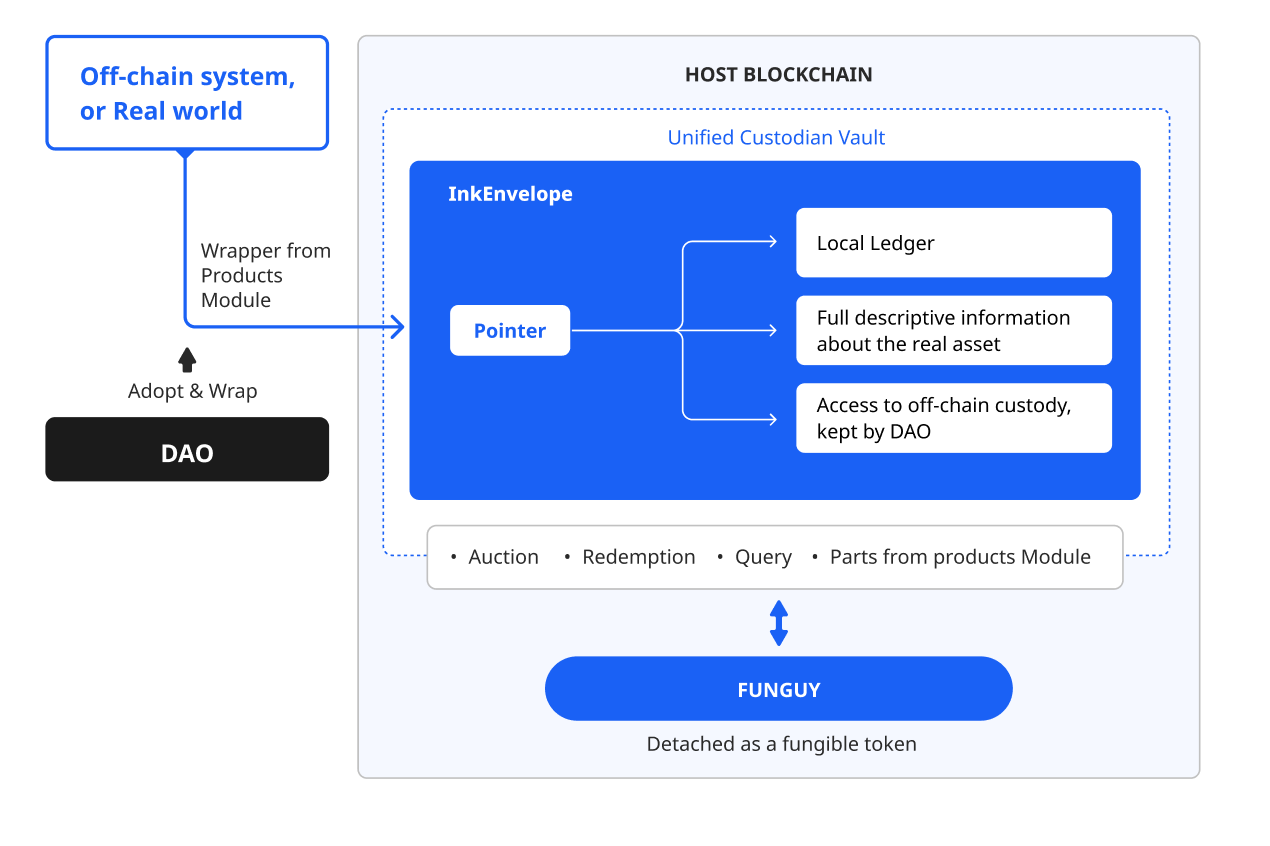

The INK Products Module allows DAOs to make customizations around the InkEnvelope, such as:

Wrap the results of an INK DAO’s off-chain asset adoption into InkEnvelopes, the uniform on-chain digital assets.

Create financial products that are collateralized (or backed) by the Enveloped assets, or that use InkEnvelopes to hold such assets as their portfolio components. These created financial products can then be made available to investors through “on-the-go” auctions or fundraising, such as legit crowdfunding

Redeem financial products with on-chain settlement and clearing

Set risk control triggers and other operation triggers for the financial products

Query and parse information regarding the assets or the financial products, i.e., peek into the InkEnvelopes

With this Module, the complicated features of bespoke assets and financial products are made easy to process and understand. INK doesn't just set up a DAO—it also gives the DAO all the tools to do its financial job. The following are several use cases that demonstrate the capabilities of the INK Products Module.

A Singleton Product of Equity, Property, or Rights

The simplest security in the real world is an equity stock, yet the complexity of issuing such a simple instrument is greatly underappreciated. While minting a fungible token on a blockchain to represent ownership of equity or property is intuitive, it lacks a tangible connection to what is being represented. It is critical for serious investment decisions on blockchains to be based on the real meaning carried by digitally transferrable tokens. INK Finance solves this problem by encompassing such critical information in a high-level construct, the InkEnvelope, and providing tools to handle, process, and interpret these envelopes. A singleton product (or security) can now have the necessary information associated with it, provided that it is issued with tools from INK’s Products Module. The following illustration describes how a singleton equity-like product carrying off-chain information can be issued by an INK DAO.

InkEnvelope Use Case - Simple Security of Share, Property, or Rights

Fixed Income Products with Option-like Risk Control

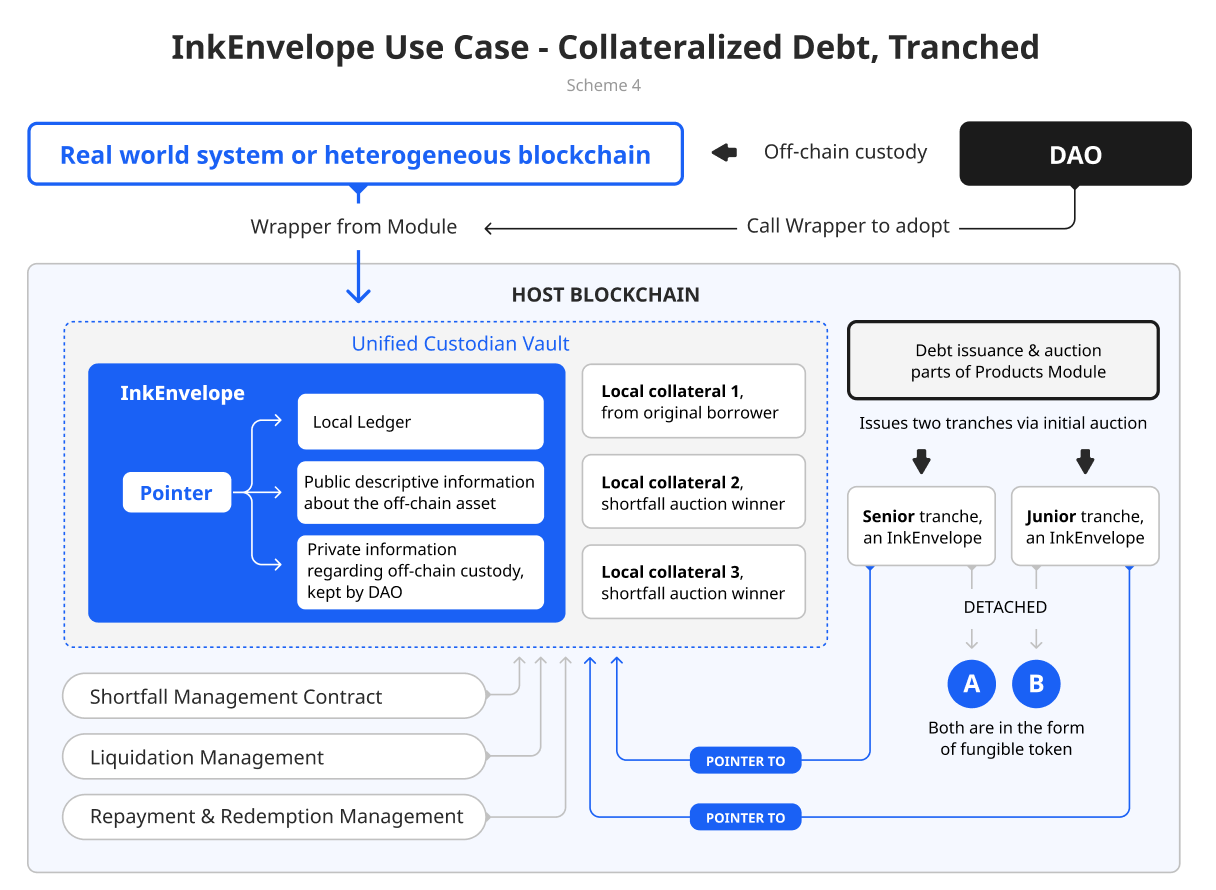

The unique risk management tool offered by the INK Products Module is likely the most innovative risk management scheme in the DeFi domain. Every original pledger is stressed when the price of their collateral drops sharply, and the tendency is to default on the obligation of making up the shortfall. The goal of INK’s shortfall auction mechanism, part of the Products Module, is to encourage others to fulfill the obligation with a significant potential reward, by activating a collateral shortfall auction before triggering the liquidation process. This avoids delinquency instead of forcing one, which liquidations tend to do. The winner of such auctions shall deposit enough collateral to make up for the shortfall to restore the original pledge ratio. The winner is then granted the right of control of the collateral vault. When the collateral price recovers enough to make a risk-free profit, the winner can buy back the outstanding debt with interest and take possession of the original collateral plus their own shortfall maintenance collateral. This auction is similar to the bidding of a call option on the collateral, except in INK’s mechanism the premium is not spent when the option is exercised because the collateral vault includes it. In addition to this dynamic credit enhancement scheme, INK also introduces a game-like tranching mechanism to provide market-driven risk and reward distribution at the initial placement auction. Any investor can choose to take a senior or junior position in the debt financing deal, and INK’s formula automatically adjusts the risk and reward of the two different positions as they are being formed by different investors, allowing them to express their different levels of risk tolerance. The following diagram illustrates how to use the INK Products Module to issue a collateralized debt product (a note or bond) with two tranches (token A and B):

InkEnvelope Use Case - Collateralized Debt, Tranched

Asset Management Products

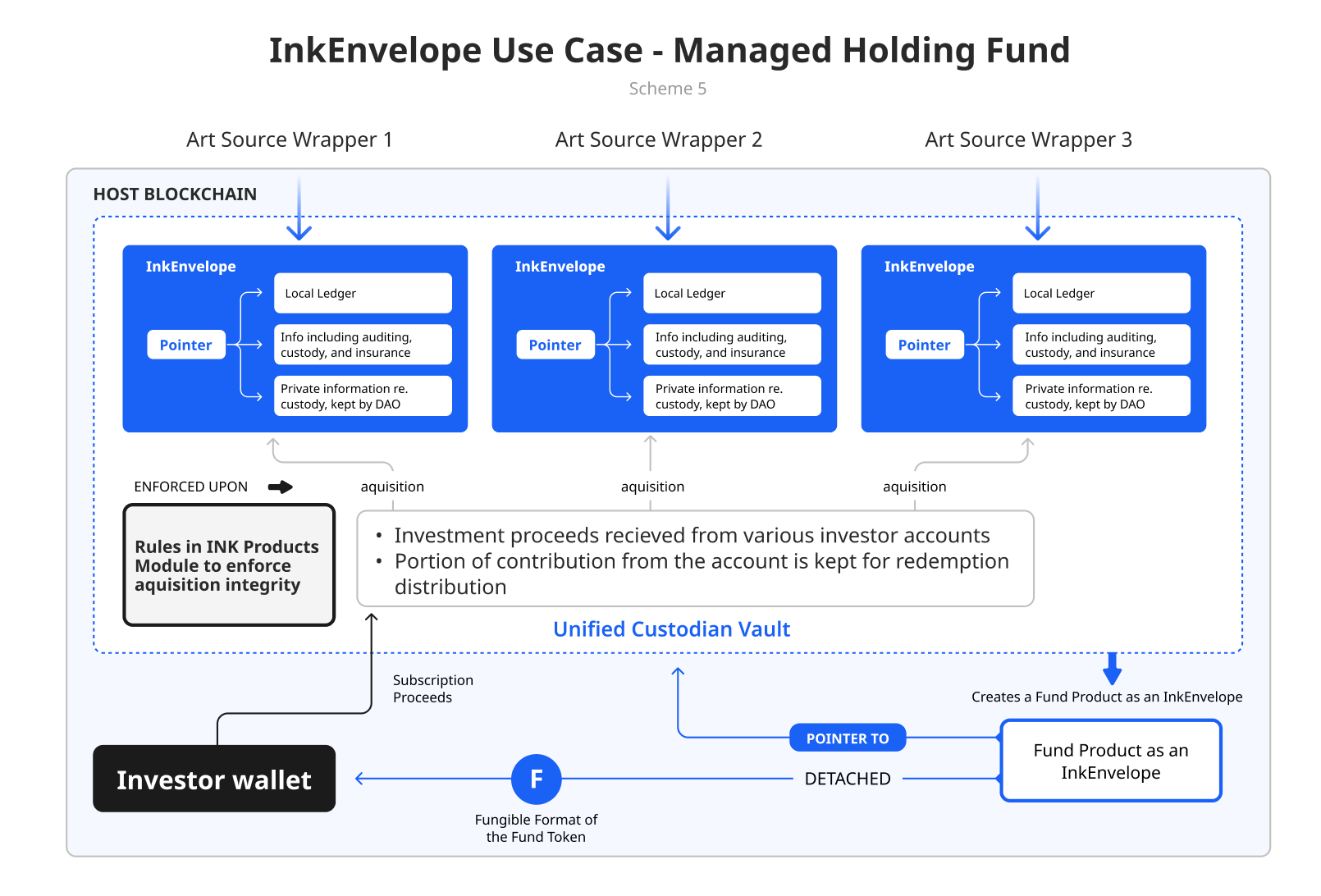

Asset management requires raising proceeds first and then deploying them toward investment purchases. In this class of applications, INK’s Unified Custodian Vault (UCV) must first be used to hold investors’ deposits and then used to hold the targeted components of the investment portfolio. The INK Products Module guarantees that any outflow of proceeds is for strictly purposed acquisitions only. It also guarantees that the final liquidation proceeds are sent back to the vault for redemption distribution.

Example 1 - A Secondary Market Focused Fund

An ETF, or Exchange Traded Fund, is a passively managed fund, which is invested in a portfolio of multiple products that are chosen according to a preset formula of specific member composition. Note that shares of such funds can be listed and traded on an exchange (hence an ETF). This is assured by InkEnvelope’s abstraction power—any financial product can be detached from the INK domain as a fungible token, making it immediately tradable on any locally available DEX. With the INK Products Module, an asset management DAO can specify composition formulas with eligible members and execution rules (such as which DEX to use). The ETF constructor supports two redemption modes: liquidation at maturity and instantaneous swap. The latter allows an investor of a fund token to swap it back to the vault in exchange for component tokens, enabling arbitrage trading. The convenience of such modulated construction of financial products is apparent, particularly for small-to-mid-sized DAOs seeking to quickly launch their fund operations to service, and hopefully, build up their fellow investors.

Example 2 - A Private Holding Fund

A private fund can hold the ownership of anything from the off-chain world that is neither in an immediately tradable format nor in an established marketplace. It is by nature discretionarily managed, and the integrity of the operation is key. The INK Products Module attaches rules regarding outflowing proceeds, to make sure they strictly go through the managing DAO’s governance structures. When used properly, such a fund format can become a SPAC-like (Special Purpose Acquisition Company) acquisition vehicle, a powerful “raise first and build up later” scheme that can target collectible arts, film production rights, or metaverse assets. InkEnvelope’s abstraction power enables complicated fund management details to be fully encompassed within the Envelope structure, making such funds available to regulated crowdfunding institutions or regulated on-chain auction houses. The following illustration (Scheme 5) shows a managed fund intended to acquire and hold different real-world artworks after the proceeds are raised

Last updated