Stake, Pledge, and Badge

The voting power on Ink Finance is the Pledge Value, derived from a voter's staking position of the governance token. A DAO can balance this economic stake with Badge that represent community value.

Typically, a DAO's staking contract has different lockup terms, each with its own weight. The weight of a term determines the reward premium (above the one day staking) a depositor can earn. The default term is one day.

The weight of a term not only determines a staker's premium in earning rewards, but also the relative importance in governance. A user is required to prove this importance (when managing or voting) by pledging the staked positions. A user's pledge value for a particular term is defined as:

pledge value = number of staked tokens * weight of the term

All staked tokens with different terms will be summed up to produce the total Pledge Value of one user.

A manager of a DAO is required to pledge a certain amount of staked tokens to stay in the management. These pledges are soft locked and can only be released until the manager is removed from duty.

A public voter must pledge a certain number of staked tokens to cast effective vote on a proposal. The bigger the pledge value, the more effective the vote will be. These pledges are soft locked and can only be released until the proposals being voted expires.

While having "skin in the game" is crucial in governance, many DAOs put community value ahead of economic stake. Such DAOs can require their voters to hold the DAOs' Badge in voting. In these DAOs, voters typically earn the badges (as opposed to purchase them). Note that after the badge holders enter the voting, the effectiveness of voting is still measured by the pledged stake.

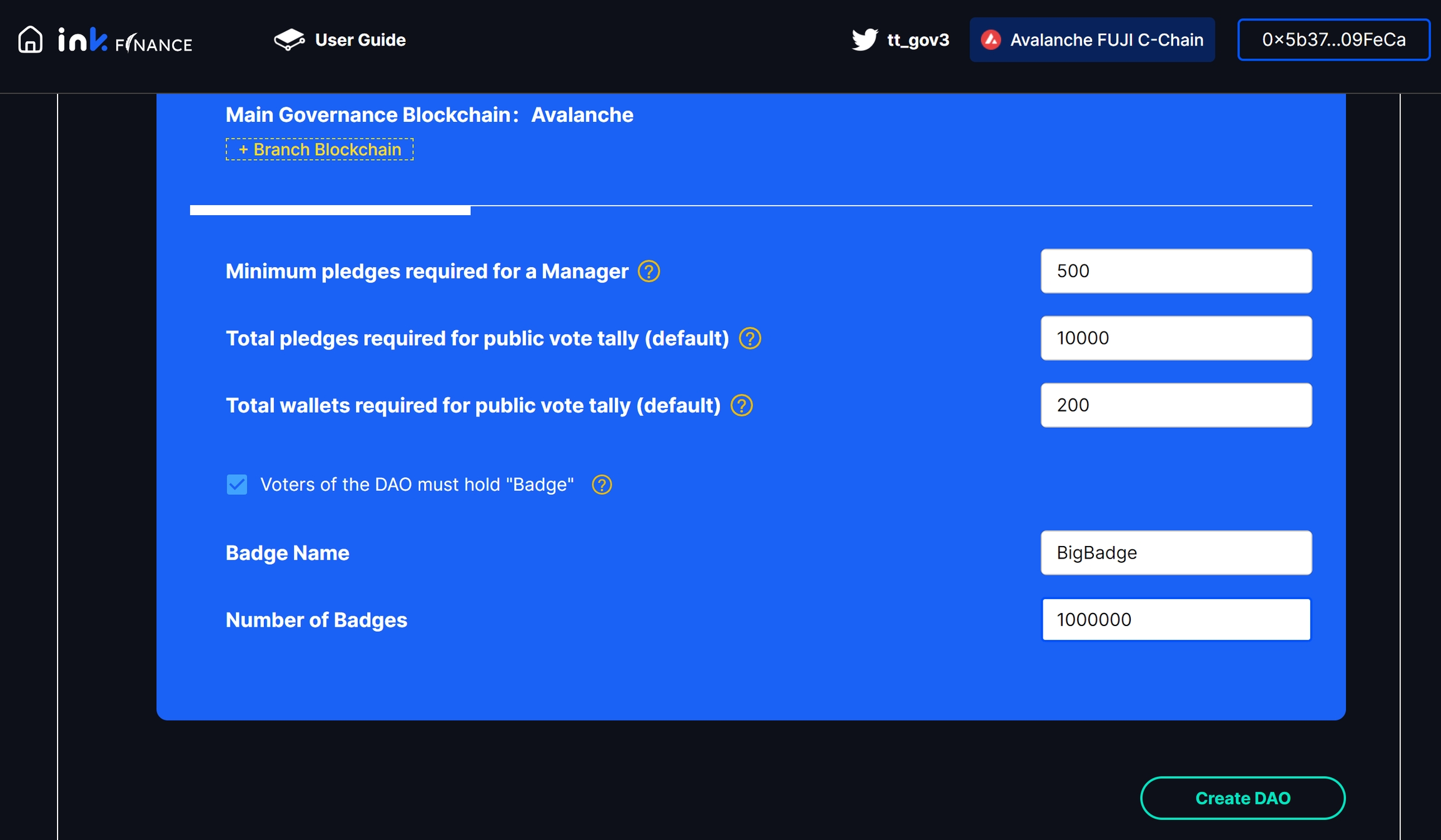

When a DAO is created, the required number of pledges for a Manager, the minimum total number of pledges in an public vote, and the minimum number of voting wallets are specified by the DAO creator.

Last updated